The Insurance Meaning Statements

Wiki Article

All About Insurance Ads

Table of ContentsThe 10-Minute Rule for Insurance CompaniesThe Of Insurance AccountExamine This Report on Insurance AgentInsurance Agent Can Be Fun For AnyoneNot known Details About Insurance Quotes

Other kinds of life insurance coverageGroup life insurance coverage is generally supplied by employers as component of the firm's work environment advantages. Premiums are based on the team all at once, instead of each individual. As a whole, employers offer standard protection totally free, with the choice to acquire extra life insurance if you need extra coverage.Mortgage life insurance covers the present equilibrium of your mortgage as well as pays to the lender, not your household, if you pass away. Second-to-die: Pays after both insurance policy holders pass away. These plans can be used to cover estate taxes or the treatment of a reliant after both insurance holders pass away. Frequently asked concerns, What's the finest kind of life insurance policy to get? The finest life insurance policy plan for you comes down to your requirements as well as spending plan. Which sorts of life insurance policy offer versatile costs? With term life

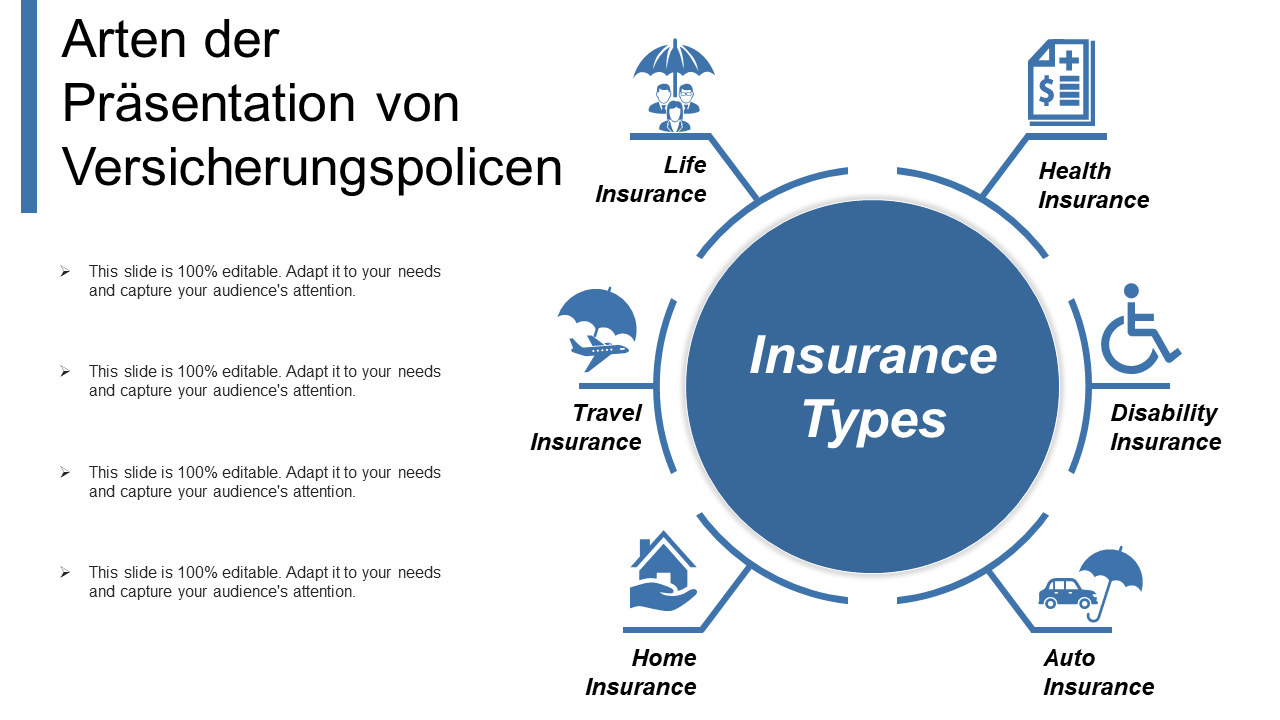

insurance policy and entire life insurance policy, costs generally are repaired, which implies you'll pay the exact same amount each month. The insurance policy you require at every age varies. Tim Macpherson/Getty Images You need to purchase insurance to safeguard yourself, your family, and also your wealth. Insurance could save you hundreds of dollars in the event of an accident, disease, or catastrophe. Health and wellness insurance policy and also vehicle insurance are required, while life insurance policy, home owners, tenants, and also disability insurance coverage are motivated. Get going for free Insurance isn't the most thrilling to think of, yet it's neededfor securing yourself, your family members, and also your riches. Crashes, ailment, as well as disasters take place at all times. At worst, events like these can dive you right into deep monetary destroy if you don't have insurance coverage to draw on. Plus, as your life changes(say, you get a brand-new work or have an infant)so ought to your coverage.

Insurance Fundamentals Explained

Below, we've explained briefly which insurance policy protection you must strongly consider getting at every stage of life. Note that while the plans listed below are organized by age, certainly they aren't good to go in rock. Several people probably have temporary impairment through their company, long-term handicap insurance policy is the onethat his comment is here many people require and do not have. When you are damaged or sick and also not able to function, special needs insurance coverage gives you with a portion of your salary. When you exit the functioning globe around age 65, which is commonly the end of the lengthiest policy you can acquire. The longer you wait to purchase a policy, the higher the eventual cost.If a person else depends on your income for their economic health, after that you most likely need life insurance. The finest life insurance plan for you depends on your budget as well as your economic objectives. Insurance you require in your 30s , Homeowners insurance coverage, Homeowners insurance policy is not required by state regulation.

The Insurance Agent Job Description Statements

Endowment Policy -Like a term policy, it is likewise legitimate for a particular period. Money-back Policy- A specific portion of the amount ensured will certainly be paid to you periodically throughout the term as survival benefit. -Your household obtains the whole amount ensured in case of death during the policy period.What is General Insurance coverage? A general insurance coverage is a contract that provides financial compensation on any kind of insurance broker meaning loss besides fatality. You could, therefore, go on and surprise your partner with a ruby ring without fretting about the treatment costs. The damage in your cars and truck really did not cause a damage in your pocket. Your electric motor insurance policy' very own damage cover paid for your vehicle's damages triggered by the crash.

How Insurance Account can Save You Time, Stress, and Money.

Your health and wellness insurance took treatment of your treatment prices. As you can see, General Insurance policy can be the answer to life's numerous issues. Pre-existing diseases cover: Your wellness insurance coverage takes care of the therapy of diseases you might have before acquiring the health and wellness insurance plan.Two-wheeler Insurance coverage, This is your bike's guardian angel. It's comparable to Car insurance policy. You can not ride a bike or mobility scooter in India without insurance coverage. As with auto insurance policy, what the insurer will certainly pay depends upon the kind of insurance policy as well as what it covers. 3rd Party Insurance Policy Comprehensive Automobile Insurance, Makes up for the damages created to one more person, their car or a third-party building.-Damage caused as a result of manufactured activities such as riots, strikes, etc. House framework insurance This shields the structure of your house from any kind of kinds of dangers as well as problems. The cover is also prolonged to the long-term components within your home such as bathroom and kitchen fittings. Public liability protection The damages created to another person or their my response building inside the insured home can also be compensated.

Report this wiki page